Decision making is more often than not based on some sort of financial evaluation of the expected outcome. Discounted cash flows, internal rate of return, net present value, I’m sure you use one, if not all, of these financial methods. Are these methods enough to mitigate the underlying risk of decision making? Check out how RATs and CATs can help your decision making.

During an amazing Global Strategy course at MIT Sloan, professor Donald Lessard argued that taking a decision to internationalize a company cannot be solely based on the mere financial evaluation of the margin you can extract from exploiting your resource base and scale on a given market. You need to take into consideration your capabilities, because those are the “secret sauce” that may well justify that decision. And it’s not only about considering the capabilities you have but also the capabilities you are bound (or not) to acquire by taking that decision.

This is such a powerful concept that I argue that the more general resource allocation decision process is incomplete if we do properly evaluate our capabilities, present and the ones we’re able to acquire because of our decision. Although financial return is critical, the actual ability to capture and deliver value is severely affected by the fact that our capability set is not proper or adequate to the challenge at hand. Furthermore, as improvement is the fuel of sustainability, if our decision does not allow us to enhance our capability set, we’re not helping our future. But how can we think of a conceptual framework to evaluate how our capability set helps or undermines a strategy? Well, we’ve got to use RATs and CATs.

RATs are a way of assessing how our current capability set helps us in pursuing the strategy framed by our decision process. In order to assess our current capability set, we need to classify it by determining how it is:

-

Relevant. Our capability set is highly relevant if we are outstanding in one or more key competences required to execute the strategy. Our capability set is irrelevant if we do not fare well in at least one required competence;

-

Appropriable. Our capability set is highly appropriable if our competences are remarkably unique and very difficult to match. This gives us an ability to outperform competition or traverse rough spots during strategy execution. Our capability set is not appropriable if we are not able to differentiate ourselves from the competition or if they are easily replicated;

-

Transferable. Our capability set is highly transferable if we control the required landscape and resources to deliver our competences. This allows us to capture the value created and delivered. Our competency set is not transferable if we are dependent on others to exercise our competencies.

CATs are a similar way of assessing how our capability set changes as a result of executing the strategy framed by our decision. Assessing the capability set resulting from executing the strategy is a matter of understanding how it is:

-

Complementary. The resulting capability set is highly complementary if we can create or develop competencies that enhance or extend our existing capabilities. This allows us to improve our performance, address other relevant markets and approach more challenging strategies, namely by having a better RAT in the future. The resulting capability set is not complementary if we’re not able to create other competencies or if the acquired competencies stray too far from our core goal;

-

Appropriable. If the newly acquired capabilities are extremely difficult to replicate or are based in competencies which are difficult to obtain, the capability set is highly appropriable. Conversely, if the new competencies are not differentiated or are easily acquirable, the competency set is not appropriable;

-

Transferable. If new competencies are usable, controlled and applicable using only resources or additional competencies that are controlled by us, then the new competency set is highly transferable. Otherwise, the new competency set is poorly transferable.

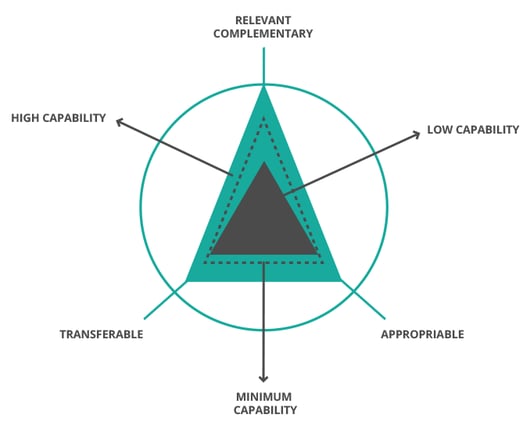

So, we’re looking for cases where our current capability set is remarkable, i.e. with a big RAT, and our future capability set is strong, i.e. a perfect CAT. To make it easy to put this in your decision process, I’ve started using simple radar diagrams that overlay the different decisions as they relate to both their RAT and CAT analysis. Check it out:

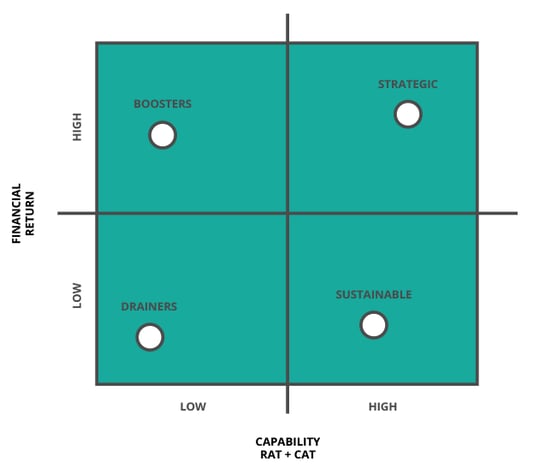

Finally, you need to put this in perspective by merging both financial and capability evaluation and check which are the decisions that take you further. I use a straight forward magic quadrant combining financial and capability evaluation to understand where the different opportunities are located:

So, we’re looking to choose those that are on the high capability, high return quadrant. You still have resources after you exercised those prime cut opportunities? Well, I go for the high capability low return opportunities, but then again I’m all in favor for sustainability.